Day Trade Tips: Boosting Your Profits in the Stock Market

Introduction:

Day trading is an exhilarating yet challenging endeavor that requires knowledge, skill, and strategic thinking. In this article, we will provide you with a comprehensive overview of day trade tips, exploring what it entails, the different types, popular strategies, and quantitative measurements. Additionally, we will delve into the variations and historical analysis of the advantages and disadvantages associated with various day trade tips. So grab your pen, tighten your seatbelt, and get ready to enhance your day trading expertise!

Understanding Day Trade Tips

Day trade tips refer to the strategies, techniques, and principles employed by traders to execute quick trades within a single trading day, aiming to profit from intraday price movements. Unlike long-term investing, which involves holding positions for months or years, day trading involves opening and closing positions within the same trading session. Traders exploit market volatility, striving to capitalize on short-term price fluctuations.

Types and Popular Day Trade Tips

There are various types of day trade tips, each catering to different trading styles and risk appetites. Let’s explore some of the popular ones:

1. Scalping:

Scalping involves making multiple trades throughout the day, aiming to profit from small price movements. Traders executing scalping strategies typically hold positions for a few seconds to minutes, capitalizing on brief price oscillations.

2. Trend Trading:

This strategy focuses on identifying and riding the prevailing market trends. Traders using this approach analyze price charts, indicators, and volume to determine the direction of the market and enter positions accordingly.

3. Range Trading:

Range trading involves identifying price ranges within which a security is trading and executing trades at support and resistance levels. Traders using this strategy capitalize on the price bouncing between these levels.

4. Breakout Trading:

Breakout traders aim to profit from significant price movements that occur after a security breaks through a defined support or resistance level. They carefully monitor price patterns and execute trades when a breakout is confirmed.

Quantitative Measurements of Day Trade Tips

Quantitative measurements play a crucial role in assessing the effectiveness of day trade tips and building successful trading strategies. Here are some key metrics:

1. Win Rate: The win rate indicates the percentage of profitable trades out of the total number executed over a given period. A high win rate suggests better trading decisions and a successful strategy.

2. Profit Factor: The profit factor measures the ratio between gross profit and gross loss. A profit factor greater than 1 signifies a profitable strategy, while a value below 1 indicates losing trades outweigh profits.

3. Average Profit per Trade: This metric measures the average profit gained per trade over a specific period. It helps evaluate the profitability potential of a day trading strategy.

Distinguishing Different Day Trade Tips

While day trade tips share the objective of generating profits from intraday price movements, they can differ significantly in approach and methodology. Factors that set them apart include:

1. Time Horizon: Different day trade tips employ various timeframes, such as scalping (very short-term) and swing trading (holding positions for a few days). Traders must choose a strategy that aligns with their desired time commitment.

2. Risk Tolerance: Some day trade tips, like scalping, carry high-risk due to the increased frequency of trades and potential for rapid market reversals. Traders with lower risk tolerance may opt for strategies that involve lower trading frequency and reduced exposure.

3. Technical Analysis vs. Fundamental Analysis: Day trade tips may heavily rely on technical analysis, using price charts, indicators, and patterns to identify trade opportunities. However, others may incorporate fundamental analysis, considering factors such as economic news and company financials.

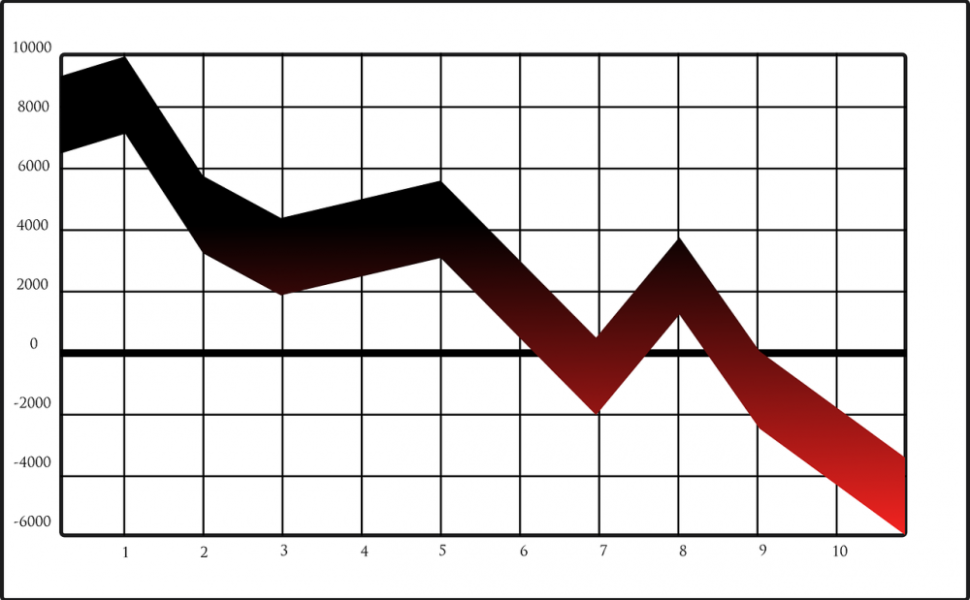

Historical Overview of Day Trade Tips’ Pros and Cons

Over time, different day trade tips have showcased varying strengths and weaknesses. Let’s take a closer look at their historical performance:

1. Scalping:

– Advantages: Scalping enables traders to make quick profits, capitalize on small price movements, and avoid overnight risks.

– Disadvantages: It requires intense focus, excellent timing, and a reliable trading platform due to the large number of trades executed.

2. Trend Trading:

– Advantages: Trend trading allows traders to capture substantial price movements and ride extended market trends, potentially leading to significant profits.

– Disadvantages: False breakouts and extended consolidation periods can result in losses, requiring traders to endure drawdowns and exercise patience.

3. Range Trading:

– Advantages: Range trading provides clear entry and exit levels, allowing for well-defined risk management and increased predictability.

– Disadvantages: Extended periods of choppiness within the range can lead to frequent stop-outs and limited profit potential.

4. Breakout Trading:

– Advantages: Successful breakout trades can generate substantial profits in a short period. Breakouts often accompany increased volume and momentum.

– Disadvantages: False breakouts are common, leading to losses if trades are not managed appropriately. Recognizing genuine breakouts requires skill and experience.

In conclusion, day trade tips offer a plethora of opportunities for traders looking to profit from short-term price movements. Whether you prefer scalping, trend trading, range trading, or breakout trading, understanding the intricacies and nuances of each strategy is vital for success. By analyzing quantitative measures, considering risk tolerance, and studying historical performances, traders can make informed decisions and boost their chances of maximizing profits in the exciting world of day trading.